Weighted Investment Performance

Weighted Investment Performance: A Clearer Picture

Evaluating investment portfolio performance isn’t as simple as looking at the raw return. A simple percentage gain doesn’t always tell the full story, especially when dealing with portfolios containing diverse assets. This is where weighted investment performance becomes crucial. It provides a more accurate reflection of how your investments are *actually* contributing to your overall portfolio gains.

The core concept revolves around assigning a weight to each investment based on its proportion of the total portfolio value. Larger investments naturally have a bigger impact, so their performance is weighted more heavily. This weighting process allows you to isolate the true drivers of your portfolio’s success or failure.

Imagine a portfolio with two assets: Asset A and Asset B. Asset A represents 80% of the portfolio and yields a 5% return. Asset B makes up the remaining 20% and yields a 20% return. A simple average of these returns would suggest a 12.5% overall return. However, this is misleading. The weighted return paints a different picture. To calculate the weighted return:

- Multiply each asset’s return by its respective weight in the portfolio.

- Sum the results of these multiplications.

In this example: (0.80 * 5%) + (0.20 * 20%) = 4% + 4% = 8%. The weighted return is 8%, significantly lower than the simple average. This demonstrates the importance of considering asset allocation. While Asset B performed exceptionally well, its smaller weight limited its overall impact on the portfolio.

Calculating weighted performance becomes even more valuable when comparing portfolios or evaluating investment managers. If two portfolios both report a 10% return, the portfolio with better risk-adjusted, weighted returns – meaning returns achieved with less volatility in the higher-weighted assets – is arguably the better performer. Furthermore, you can use weighted returns to isolate problem areas within your portfolio. If a heavily weighted asset is consistently underperforming, it signals a need for review and potential reallocation.

Most brokerage platforms and portfolio management software automatically calculate weighted performance. Understanding the underlying principles allows you to critically analyze the results and make informed decisions about your investments. By focusing on weighted performance, investors gain a clearer, more nuanced perspective on the effectiveness of their portfolio and can proactively adjust their strategies to optimize returns.

848×1414 investment performance evaluation investment performance measurement from greenwichbeta.com

848×1414 investment performance evaluation investment performance measurement from greenwichbeta.com

1280×500 investment performance nationwide super from www.nationwidesuper.com.au

1280×500 investment performance nationwide super from www.nationwidesuper.com.au

4694×1975 investment performance oakglen wealth from oakglenwealth.com

4694×1975 investment performance oakglen wealth from oakglenwealth.com

587×330 time weighted money weighted investment returns from fundingsouq.com

587×330 time weighted money weighted investment returns from fundingsouq.com

1800×1080 measuring investment performance spectrum ifa group from spectrum-ifa.com

1800×1080 measuring investment performance spectrum ifa group from spectrum-ifa.com

971×301 investment performance worth knowing from www.performancemeasurementsolutions.com

971×301 investment performance worth knowing from www.performancemeasurementsolutions.com

1000×662 measuring investment performance effectively tekrati february from www.tekrati.com

1000×662 measuring investment performance effectively tekrati february from www.tekrati.com

875×883 investment performance definition key performance metrics from www.financestrategists.com

875×883 investment performance definition key performance metrics from www.financestrategists.com

1055×267 money weighted return calculator from www.portseido.com

1055×267 money weighted return calculator from www.portseido.com

1200×628 measure investment performance ethical capital from ethicic.com

1200×628 measure investment performance ethical capital from ethicic.com

747×456 solved investment portfolio shown technology from www.gauthmath.com

747×456 solved investment portfolio shown technology from www.gauthmath.com

1740×1110 time weighted returns money weighted returns from blog.investingnote.com

1740×1110 time weighted returns money weighted returns from blog.investingnote.com

850×452 comparative overview weighted values key performance from www.researchgate.net

850×452 comparative overview weighted values key performance from www.researchgate.net

640×300 measure investment performance empower from www.empower.com

640×300 measure investment performance empower from www.empower.com

830×696 dont investment performance sgmoneymatters from www.sgmoneymatters.com

830×696 dont investment performance sgmoneymatters from www.sgmoneymatters.com

1766×1264 investment performance from www.tbf.org

1766×1264 investment performance from www.tbf.org

850×561 performance investment options scientific diagram from www.researchgate.net

850×561 performance investment options scientific diagram from www.researchgate.net

1286×564 investment performance measurement methods formulas examples from www.mycapitally.com

1286×564 investment performance measurement methods formulas examples from www.mycapitally.com

850×475 optimal investment policy weighted average approach notes from www.researchgate.net

850×475 optimal investment policy weighted average approach notes from www.researchgate.net

1024×1024 investment performance retire gen from retiregenz.com

1024×1024 investment performance retire gen from retiregenz.com

1280×720 factors impacting constant weighted asset strategic investment plan from www.slidegeeks.com

1280×720 factors impacting constant weighted asset strategic investment plan from www.slidegeeks.com

850×480 weighted performance portfolios terms financial from www.researchgate.net

850×480 weighted performance portfolios terms financial from www.researchgate.net

320×180 investment performance measurementpptx from www.slideshare.net

320×180 investment performance measurementpptx from www.slideshare.net

2000×1250 time weighted money weighted rates return from www.sharesight.com

2000×1250 time weighted money weighted rates return from www.sharesight.com

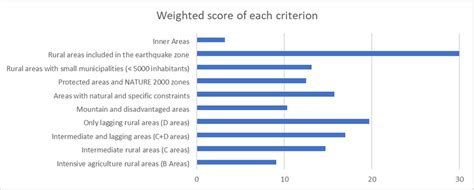

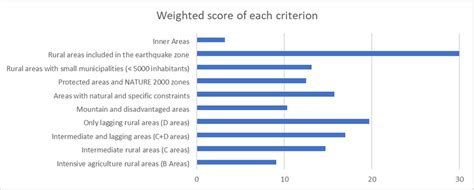

850×342 weighted score investment criteria type criterion source from www.researchgate.net

850×342 weighted score investment criteria type criterion source from www.researchgate.net

432×216 comparing equal weighted portfolios ben davies from bldavies.com

432×216 comparing equal weighted portfolios ben davies from bldavies.com

500×182 overview global investment performance standards flashcards from quizlet.com

500×182 overview global investment performance standards flashcards from quizlet.com

720×540 evaluation investment performance powerpoint from www.slideserve.com

720×540 evaluation investment performance powerpoint from www.slideserve.com

1024×1024 measure investment performance retire gen from retiregenz.com

1024×1024 measure investment performance retire gen from retiregenz.com

180×233 understanding investment performance expected returns hero from www.coursehero.com

180×233 understanding investment performance expected returns hero from www.coursehero.com

946×1024 solved weighted growth rate investment cheggcom from www.chegg.com

946×1024 solved weighted growth rate investment cheggcom from www.chegg.com

1280×720 investment performance measurement powerpoint google cpb from www.slideteam.net

1280×720 investment performance measurement powerpoint google cpb from www.slideteam.net